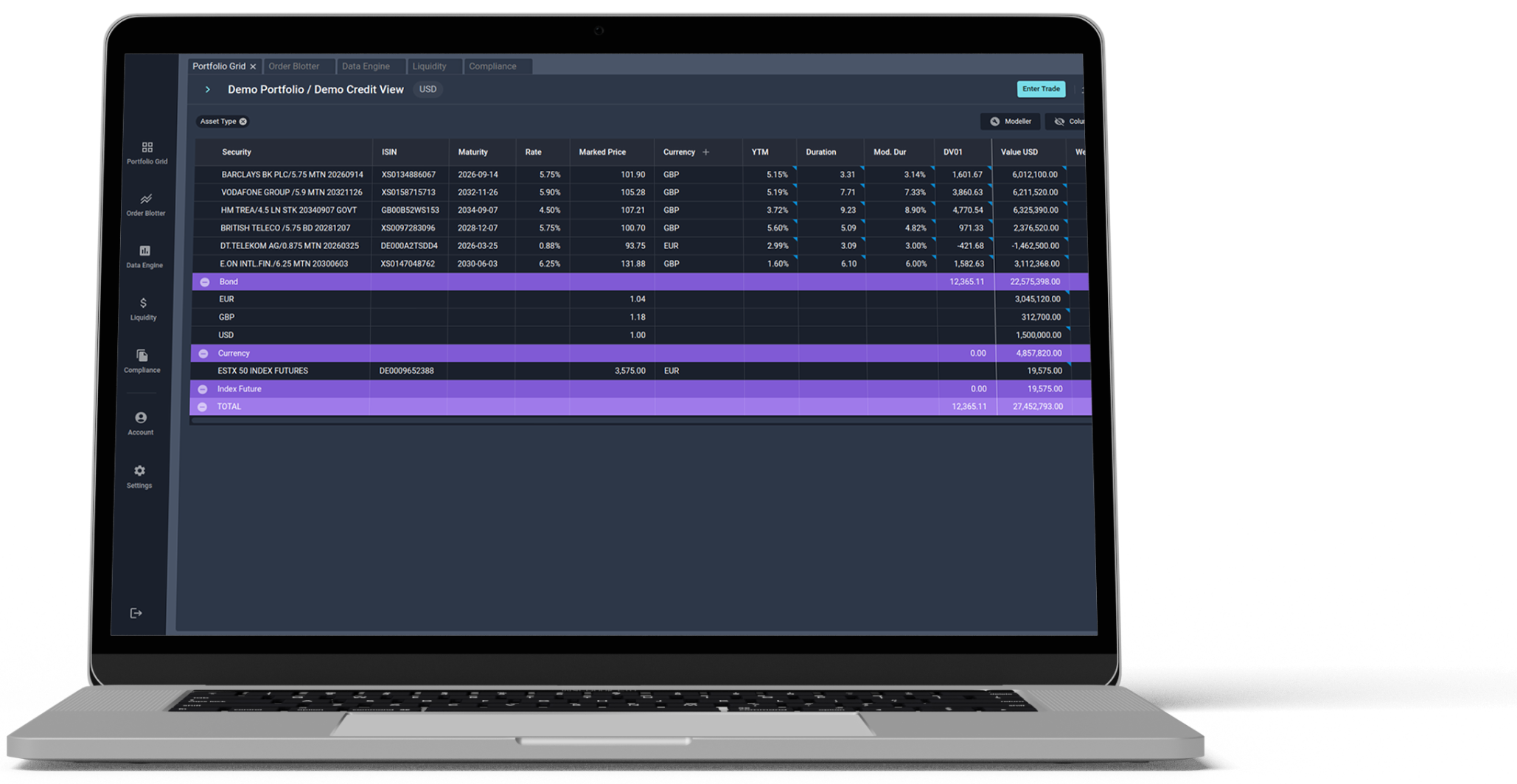

A specialist platform for credit-based strategies

The Arcfina platform has been designed from the ground up to fully support credit strategies and workflows, specifically addressing the key nuances of this important, yet under-serviced, market sector.

- Integrates portfolio, order and risk management into a single platform supporting the full trade lifecycle across multi-asset

- Specialist focus on credit and associated derivative products, including bonds, loans, repo, IRS, TRS, CDS, FX and more

- Deep and transparent portfolio analytics including exposures, compliance, risk, market value, net asset value and P&L

- Multi-currency, FX, collateral and margin management, fixed and floating accrued interest

- Yield curves, risk-free curves, credit curves management and interpolation

- Integrated with ISDA CDS Standard Model for present value and upfront payment calculations

- Flexible portfolio construction and analysis grid to filter, slice and dice portfolio

- Modelling, what-if scenarios and automated trade order generation

- Interactive investment compliance to enforce mandate limits

- Order management, allocations, placements & trade capture

- Fluid data model enabling custom columns, formulae, classifications and tags

- Strategy, sleeves, pairs-trading & hedging workflows

- Integrated with major market data providers and trading venues

Why Arcfina?

Specialist credit platform combining portfolio, order and risk management

Designed and developed with the specific needs of credit managers foremost, Arcfina combines portfolio and risk management onto a single platform ensuring that there need be no compromise on analytics or workflow

Highly flexible data model & analytics

Built from the ground up to accommodate multiple data sources, custom columns and transparent analytics, Arcfina has the flexibility of Excel within an enterprise software platform

Proven solution integrated with key industry platforms and standards

Used by operations teams running significant AUM, Arcfina is relied upon to provide the core investment operations infrastructure, integrated with key trading venues, market data providers and industry-standard analytics models

Quick to deploy, easy to maintain & budget friendly

Built on a modern, high-performance, cloud-native, browser-based technology, not limited by legacy architecture and eliminating the need for time-consuming and expensive upgrades

Want to find out more?

Get in touch to find out more, arrange a demonstration or to learn about the background to the Arcfina project and its raison d'être.